Business Interruption Insurance Claims Expected to Rise in 2021: How to File

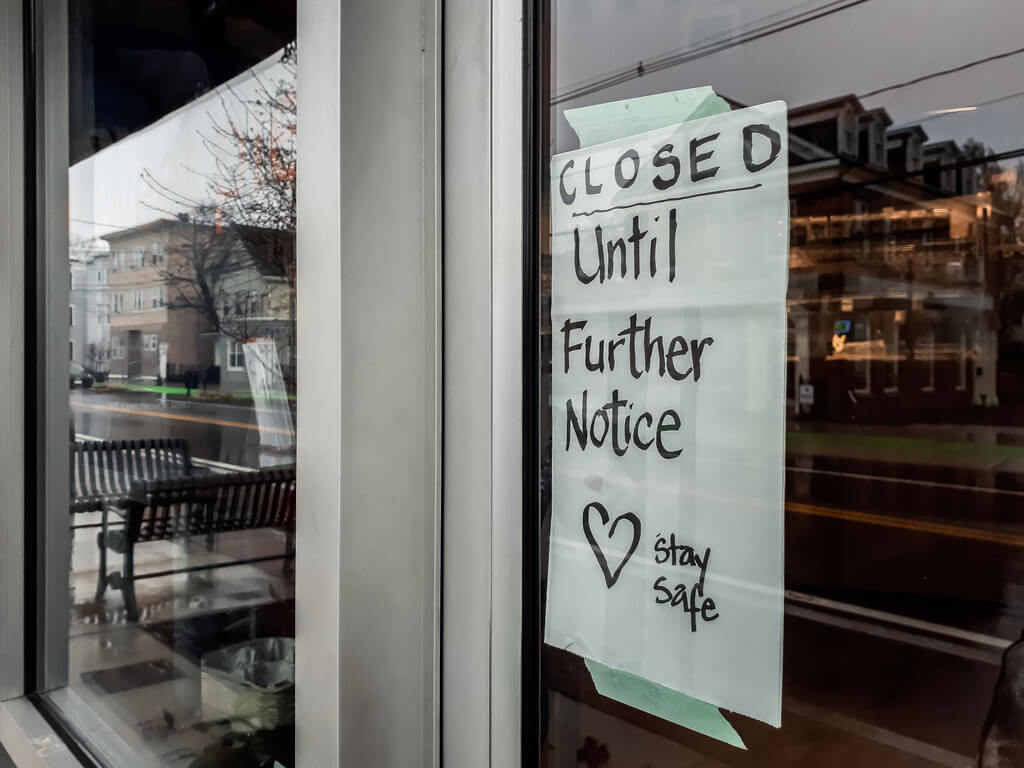

It has been estimated that hundreds to over 1,000 businesses close each day due to the horrific economic impacts of the novel coronavirus. Though a vaccine is already in distribution, many business owners have already lost so much because of COVID-19, with minimal help in sight. With no end to the pandemic expected until perhaps the fall, many businesses are wondering if now is the time to file a business interruption claim.

How to File a Business Interruption Claim

If you are questioning whether you have a business interruption claim or not, there are a few steps you need to take to begin the process.

- 1. Review your policy. The language within your policy will dictate whether or not the impacts of COVID-19 are covered under your insurance. Look for statements about actions of civil authority, losses that cannot be physically seen, etc. If you are not sure what your policy entails, call an attorney who can review the language with you.

- 2. Be mindful of deadlines and requirements. The filing process is complicated, so be diligent. Make sure you follow the close deadlines which occur after business loss, utilize the proper forms, and supply any information needed.

- 3. Gather evidence of loss. Now is when your bookkeeping really matters. Gather any and all documentation that showcases the business loss, ideally within the time frame you are claiming the event occurred.

- 4. Get legal help. In a time when everyone is working from home, going digital, and no longer working in a brick and mortar setting, you still need to find someone you can trust as you navigate the business interruption claim process. Lawyers can help you with documentation and navigate the language included in your policy.

Remember, insurance companies are doing everything they can to make sure your small business interruption claim is denied. But for every grey area they find, the legal team at Mazzoni Valvano Szewczyk & Karam can shed some light.

If you have concerns about your insurance policy and wonder if you can recoup any losses to your business as a result of COVID-19, know that you need legal guidance.

Mazzoni Valvano Szewczyk & Karam: PA Small Business Interruption Claims

If you have been denied insurance coverage as a result of COVID-19 closures and losses to your business, know that you have rights. At Mazzoni Valvano Szewczyk & Karam, we will review Pennsylvania’s small business owners’ claims and help you seek the compensation you deserve.

You are fighting to keep your business afloat. Let us fight for your legal rights. Contact the business interruption claim attorneys of Mazzoni Valvano Szewczyk & Karam today. We serve and protect small businesses across Northeast Pennsylvania.